Home loans are additionally known as liens versus residential or commercial property or claims on property. If the debtor quits paying the mortgage, the lending institution can confiscate on the property. A standard mortgage calculator can assist you comprehend the total price of your loan as well as your month-to-month repayments. An extra price-- an upfront home loan insurance policy costs of 2.25% of the financing's value. The MIP should either be paid in cash when you get the financing or rolled right into the life of the car loan.

Interest-only home loans-- With an interest-only home loan, the consumer pays only https://www.thepinnaclelist.com/articles/how-save-hours-your-life-real-estate-strategy/ the rate of interest on the loan for a collection period of time. After that time is over, usually between five and seven years, your month-to-month repayment raises as you start paying your principal. With this sort of lending, you won't build equity as quickly, given that you're originally just paying interest. These car loans are best for those that understand they can sell or re-finance, or for those who can moderately anticipate to pay for the higher regular monthly payment later on. Generally, getting a standard home mortgage indicated paying 20% of the house cost as a down payment and obtaining the remainder in a 30-year home loan.

- This additional home loan is commonly referred to as a residence equity car loan.

- Real estate tax and also the rate of interest you pay on your home mortgage are generally tax obligation deductible.

- If you have a 30-year fixed-rate loan with a 4% interest rate, you'll pay 4% interest up until you settle or refinance your financing.

- With an ARM, the preliminary price is usually less than a fixed-rate loan.

As well as from requesting a loan to managing your home loan, Chase MyHome has whatever you need. After reviewing your budget as well as what you require from your house, it's time to think about all your options. You might require to look for a finance option that enables a smaller sized deposit, or you could intend to provide yourself even more time to save up for a bigger deposit. Just how much deposit you'll need for a home depends upon the loan you obtain. While there are benefits to taking down the typical 20%-- or more-- it may not be called for. ARMs, on the various other hand, have a price that can readjust periodically.

Heres Just How Much Money You Require how to end a timeshare contract To Start An Organization, According To 10 Individuals Whove Done It

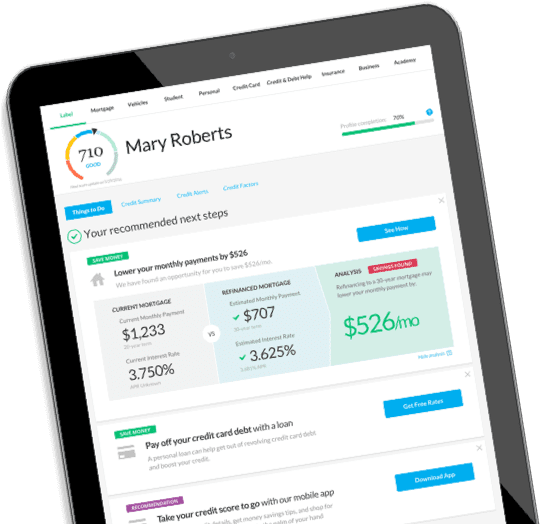

If you want learning what your credit report is, you can make use of any one of the 3 major credit scores bureaus. For the least expensive lending, you would certainly wish to have a healthy and balanced deposit. Nevertheless, you have choices that might enable you to qualify with 100% financing. Government-backed programs such as USDA and also VA offer borrowers reduced deposit funding options.

Insurance shielding the loan provider against any kind of cases that might arise from arguments about possession of the building. Needs to a problem emerge, the title insurer pays any type of lawful damages. When a loan provider evaluates a consumer's financial resources to establish how much she or he can manage to borrow and also on what terms. A guarantee of a rates of interest if a car loan is shut within a certain time.

Bankrate has partnerships with companies including, however not restricted to, American Express, Bank of America, Resources One, Chase, Citi and also Discover. We are an independent, advertising-supported contrast service. A very first home loan is the primary lien on the building that protects the mortgage and has top priority over all cases on a home in the event of default. Doretha Clemons, Ph.D., MBA, PMP, has been a corporate IT executive and also professor for 34 years. She is a complement teacher at Connecticut State Colleges & Colleges, Maryville University, and also Indiana Wesleyan University.

Credit Score Report

However, if you are a new customer, you might be entitled to declare Very first time Buyers' Alleviation, which is a reimbursement of Deposit Rate of interest Retention Tax Obligation. This information is aimed at personal individuals who are purchasing their own houses. Some states have high cost loan arrangements that don't allow a financing if the expenses of the lending are high. A rookie mortgage broker might service the offer for the experience, Funk states, or a regional bank or lending institution may do it with the hope of the consumer using its other solutions. Or the banker might work on wage instead of commission, maintaining expenses down.

A small-dollar home mortgage is typically taken into consideration to be a lending of $100,000 or much less, which is a lot less than the national typical mortgage loan amount of $184,700 in 2019. While these fundings are a little share of the general variety of home mortgages provided each year, they are important to low- and also middle-income families that are trying to buy a house. VA fundings charge a funding charge that can be rolled right into the financing as part of the mortgage. The passion you pay every month is based upon your rate of interest and also finance principal. The money you spend for passion goes straight to your mortgage provider, that passes it to the capitalists in your finance.